An overview on why blockchain fees matter.

Fees, Fees, Fees. If “Location, Location, Location” is the mantra of real estate, then this is surely the equivalence in the blockchain world. As many of you may already have had this thought, transaction fees of BitShares can be seen as the income of the platform. Thus they also account as the most feasible way a digital platform can thrive by far. Everything from A-Z that you or another user does on the network has a potential fee. We’re not just talking trading or transfer fees. Many business operations exist; from creating and issuing new tokens, sending encrypted memos or signing digital signatures.

What are Blockchain Fees for anyway?

If you have a blockchain built to support businesses or (d)Apps on top, there’s even more potential operations which can have a cost in resource terms for the network. Fees are both a tool to prevent spam, and to enable the blockchain to operate. For the BitShares blockchain (and most of it’s DPoS siblings), fixed transaction fees are imposed for each operation and replenish the reserve pool (active working budget) to cover the cost of maintaining, running, improving or marketing the platform to attract more businesses and users. Without fees, the platform would have to seek income elsewhere. With fees, it can be self-sustaining!

Additionally, part of the fees is funneled into the referral program (currently 80% of the transaction fee) and distributed to referrers that onboard into BitShares (more on that in the next section). Businesses building on top of the BitShares blockchain are also able to benefit more directly by imposing an additional market fee specifically for the trading operation. This market fee can also be shared with above-mentioned referrers, forging a strong and worth-while referral program. Without fees, businesses would have to seek alternate incentives to create services on top.

In summary, the positive feedback loop of fees is an incubator for growth of the BitShares platform.

Looking across the chains …

A quick comparison between BitShares, and one of the latest entrants to the industry, Binance Chain.

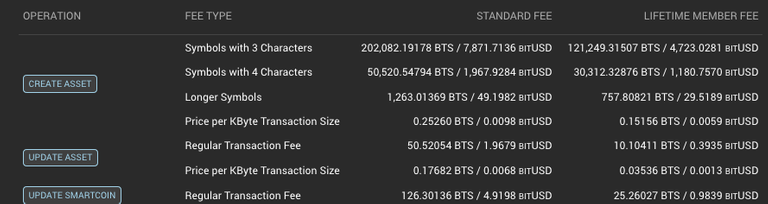

To easily check the current BitShares fees, you can do so in the reference UI here at any time. The below image also shows how to reach it for yourself in the reference UI.

You can always check https://wallet.bitshares.org/#/explorer/fees for the current fee schedule on the BitShares platform.

Lifetime Members get more from BitShares

For comparison purposes with BitShares we shall be telling you about rates for Lifetime Members (LTM). If you frequent the platform often (especially businesses, entrepreneurs, and heavy traders), you’ll will want to obtain this type of account. For ~ $100 USD (paid in BTS tokens) it currently provides you 80% of all your fees paid back to you into a “vesting balance”, claimable following a set period of time. In addition, 80% of all fees from any friends you refer and signup from your link, until they also upgrade to LTM. (You also receive final 80% of the upgrade fee).

The network is only taking 20% today

Talking point: At the current time, BitShares only collects 20% of the fees whilst giving 80% back to lifetime members and one level referral accounts. We can reveal to you this is currently being discussed in senior community circles.

BitShares has costs to run and maintain the network, fees being the primary source of income. Recently, there has been unrest in the community over how much is spent on workers, versus how much the reserve pool is growing/shrinking. A full 80% of fees are given back to users! What if the referral split was adjusted to give 60% instead? Would it help the BitShares reserve pool operate more effectively to support work around it? Consider that a new 60/40 split would essentially double the income for the network. It would remain a bargain for lifetime members – the fees are already tiny for most operations. Furthermore, if such a change was implemented the committee has the ability to balance fee schedules accordingly.

Adding up

Refer enough users (through people signing up through a dApp you build, for instance) and it can soon add up. For casual users, the fees are full price, with 80% of them going to whoever referred the account (or the faucet where the account was opened). In the end 20% (currently) of fees goes back to the network, AKA the BitShares Reserve Pool.

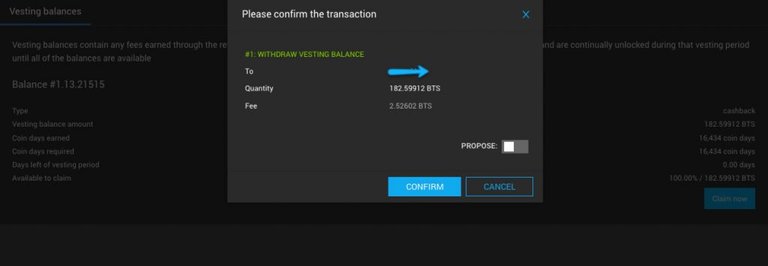

LTM user example, claiming the earned vesting balance

A comparison – Binance blockchain fees

We dug out the below from within the Binance Chain docs, which appears to be the latest fee schedule for their platform. There is no mention of lifetime memberships or tiered member fees, only flat fees. Instead, Binance provide the “Pay in BNB” option for users to obtain a discount. In other words, buy, hold, and use their coin for your fees, and receive a discount.

“Fees are variable and may change over time as governance proposals are proposed and voted on. The current fees table for Mainnet is as follows:” source

Binance published fee schedule (source)

So how do they compare?

For trading operations we are still unsure of the exact fees on Binance DEX, as fixed trading fee actions appear low, however there is only stated ‘rate based fees’ for order execution. Also, we can observe significantly less operations available at the current time when comparing to BitShares. Note Binance also state they could change in future depending on governance proposals. As that network is so new, it’s difficult to predict where it will go in future with fee levels. BitShares does have an equivalent, the Committee, who can also vote to change fees, and no incentives or gains are to be had by them personally for doing so. Historically, BitShares Committee have always adjusted fees mostly for the purpose of reflecting open market value on BTS core tokens. If the value goes up, fixed fees in BTS can be adjusted downwards and vice versa.

The below information will look into some of the non-trading related operations for comparison. Additionally, there appear to be less options to actually make comparisons than we’d thought.

- Both appear to have very low or negligible fees on certain basic trading actions.

- Comparable on Binance is only issue, mint, and listing new tokens. In BitShares, this is done in the ‘token factory’ and the process is slightly different.

Binance blockchain fees for asset creation and listing

In this case we can see a real cost.

- Issue Asset = 500 BNB

- ‘Minting’ your assets = 5 BNB (each time)

- Submitting your asset for governance decision = 5 BNB

- Listing your asset (per pair) = 1000 BNB

So, that would mean to issue, mint, propose, and list 1 new coin on Binance Chain/DEX, with 2 pairs comes out at 500 +5 + 5 + 1000 + 1000 = 2510 BNB … At current prices of $25/BNB. That comes to $87,750, a significant fee. For BitShares, small businesses just wanting to try out new business models based on their own token can do so for much less.

For BitShares, we could say that affordability and accessibility remains a goal. In true spirit of decentralization and entrepreneurship on BitShares, any business can create a token for their own use or to make their services available to the ecosystem. Just as the Internet doesn’t control who opens websites and sells goods, neither does BitShares endorse or control who can create UIA tokens. Binance appears to have bigger fees in order to perform governance (closed loop centralized ecosystem). Bigger isn’t always better!

BitShares LTM Asset Creation fees

- Create 3-letter Asset = 121,249.31507 BTS / 4,192.8924 bitUSD

- Create 4-letter Asset = 30,312.32876 BTS / 1,048.2231 bitUSD

- Issue Asset = 0.05052 BTS / 0.0017 bitUSD (normal per kb transaction fees)

User Issued Asset (UIA) fees on BitShares

User Issued Assets automatically appear in markets when trading begins, and there are no additional listing fees other than for operations performed on your created assets.

You’ll notice a difference above, on BitShares the cost of creating your asset is dependent on the length of the symbol. More letters = cheaper. The asset creation fees are clearly much lower and thus more accessible compared to Binance. The reasons for this are many and subjective, especially with one (Binance) being a lot more centralized than BitShares.

Conclusions

Any legitimate and tech-savvy business can make the comparison of fees for themselves. Some like Binance Chain may offer the branding and credibility at a much bigger fee. Alternatively they can pick BitShares for the flexibility, performance, technology and features, with small enough fees to make it accessible for businesses large and small. User impact would be minimal if and when BitShares adjusts the 80:20 referral sharing, as fees are already low. The committee can also adjust certain operations to keep everything fair. Fees should be kept low, yet they should also be adjusted to ensure the network has good budget and reserves, in order to run in-perpetuity as intended.

We only touched on market fee sharing and setting the trading fees for any business UIA and gateways. We’ll come to more business examples using blockchain fees in future articles. Remember all businesses utilizing BitShares, your own real-world case studies are always welcome on BitShares News.